In the past time, the parachains on Polkadot have continuously launched. Those ecosystems grow very fast and get a lot of community attention, there are many impressive strides, and the Astar Network ecosystem is one of such ecosystems.

To help you catch up with the Astar Network ecosystem, in this article, I will go through this ecosystem with you and answer the following questions:

- What arrays are there on Astar Network?

- What stage is the Astar Network ecosystem at?

- Looking for investment opportunities and projections of the Astar Network ecosystem.

We will find out through the next article!

Overview of Astar Network

Astar Network (formerly known as Plasm Network) is a Smart Contract Platform on Polkadot. Astar Network is built on the Substrate framework to become a parachain on Polkadot. Astar supports EVM -compatible development applications, WebAssembly, and many other layer-1 blockchain applications.

Being Parachain allows data and tokens on Astar Network to be transferred between parachains seamlessly, while Astar Network also gets security from Polkadot's relay chain.

Shiden Network operates as an R&D chain of Astar Network on Kusama. Astar & Shiden have the same code base but are deployed on two different chains, Polkadot & Kusama, they have different native token & tokenomic.

Highlights of Astar Network

Astar Network has the following outstanding features:

- The Astar & Shiden Network solves outstanding scalability and interoperability issues by supporting Dapp building in various programming languages such as Ethereum's Solidity & Parity's ink! by Polkadot (Parity's ink!: ink! is the native language on Substrate created by Parity Technologies).

- Wide choice of programming languages: Astar & Shiden supports both WASM and EVM. So developers can deploy Solidity contracts on Astar & Shiden using existing Ethereum tools like Metamask and Remix. In addition, developers can also deploy Solidity contracts on WASM with Solang.

Outstanding parameters

Outstanding parameters of Astar Network blockchain (February 10, 2022):

- Decimals: 18.

- Holders: 58,200.

- Total transactions: 65,983.

- Blocktime: 12s.

- Total number of wallets: 5,524.

- Number of transactions in 24 hours: 2,046.

- Block Height: 380,350.

- Marketcap: $198 million.

- Astar dApps Staking: $480 million.

- Programming languages: Solidity, WebAssembly,...

The parameters can be monitored at Astar Network's explorer: astar.subscan.io/

History, current situation and roadmap

Astar Network has gone through a long development path and has many memorable milestones (February 10, 2022):

- Dusty Network (11/2019): Run project testnet.

- 1st Lockdrop Program (December 2019): 1st token distribution.

- Plasm Network Mainnet (June 2020): Run the project mainnet.

- 2nd Lockdrop Program (September 2020): Distribution of tokens for the 2nd time.

- Renamed Astar Network (June 2021).

Project investors and partners

Astar Network is invested by many funds in the market: Alchemy Ventures, ROK Capital, Vessel Capital, Crypto.com Capital, OKX Blockdream Ventures, TRGC, Longhash Ventures, Animal Ventures, Injective Protocol, Stake Technologies, Scytale Ventures, PAKA, Richard Ma, Alameda Research, Kernel Ventures, HashKey Capital, Digital Finance Group, Binance Labs, GSR, Polychain Capital, WealthUnion, Huobi Ventures, and Gavin Wood.

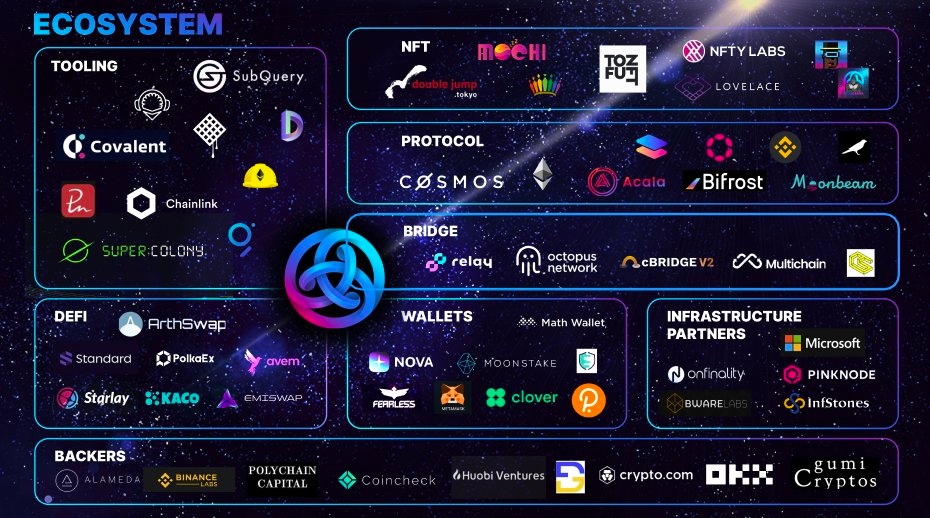

Pieces of the Astar Network ecosystem

An overview of the puzzle pieces on Astar Network will be introduced and analyzed in the following section, according to the categories in the ecosystem. Information is synthesized by myself through skinning the Astar Network system on Twitter as well as searching by token on Astar Network's explorer (February 10, 2022).

DEX

Projects working on the Astar Network ecosystem include:

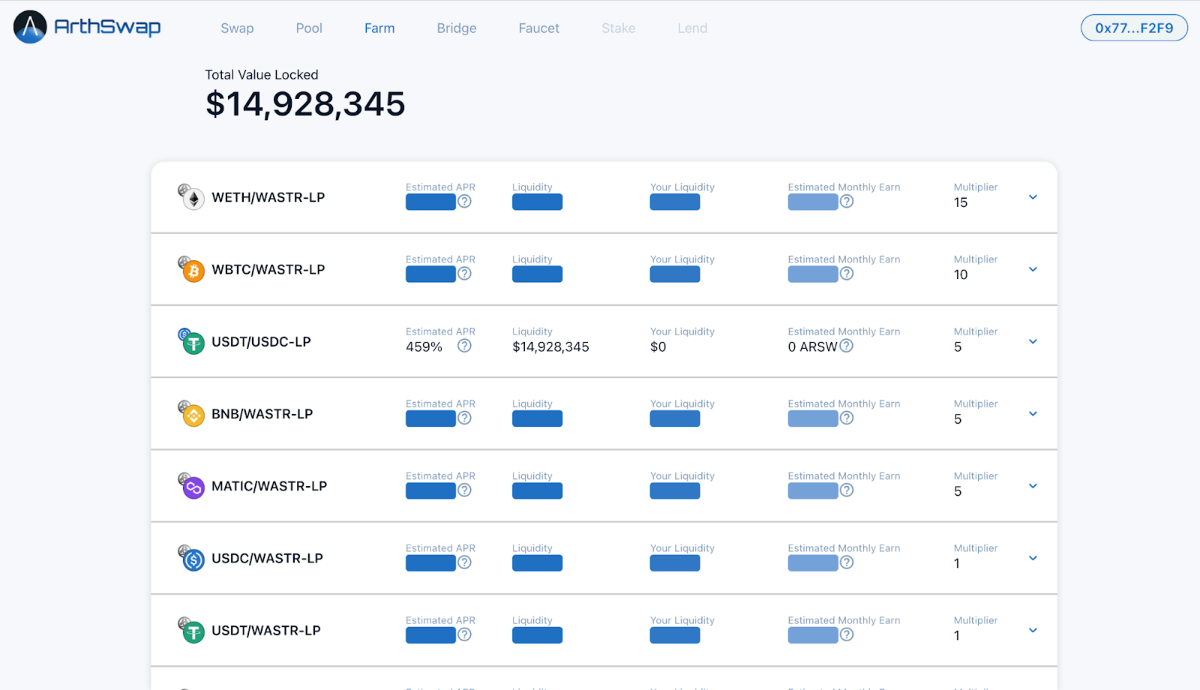

- ArthSwap: Uniswap V2 fork version , currently token is not launched but farming is being launched before token launch, assuming ARSW project token price is $0.175. TVL is currently 15 million dollars. The project has products similar to PancakeSwap in the stages of Swap, Liquidity Providing, Liquidity Mining, Staking, and in the future will develop like Trader Joe on Avalanche. Currently, this is the largest DEX on Astar Network. The project received a $1.5 million seed round investment from DFG, LongHash Ventures, and Next Web Capital.

- PolkaEx: DEX project and cross-chain launchpad on projects on Polkadot. TVL is currently 1.1 million dollars.

- Emiswap: A multichain DEX, currently the project is not active on Astar Network.

Comment: The AMM DEX array is the first segment that needs to be completed in any ecosystem to be ready for the future boom of other arrays. The Astar Network system is in the early stages of perfecting the DEX array, in the early stages of developing the first major main players.

ArthSwap is still in the works, launching its first farming incentives. The remaining DEX exchanges do not receive the attention of users, the TVL is low and there are no outstanding points.

Lending

Current lending projects on Astar Network include:

- Starlay Finance: A lending project on Astar Network. Currently, the project has no website, no product, is in the process of development. Please follow along with me on this project!

The lending array is an important part of any ecosystem to increase the efficiency of the capital in the system. Having the activity of lending will open up the possibility of developing more applications in the future such as derivatives, or farm leverage,... in this fledgling ecosystem.

Let's follow the first lending puzzle pieces on Astar Network in the future.

Stablecoins

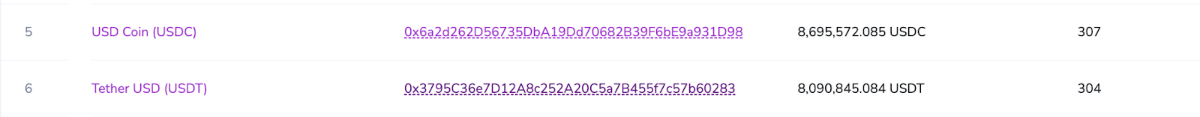

Currently, on Astar Network, the following stablecoins are available:

- USDC: $8 million;

- USDT: $8.5 million;

- Other types of stablecoins with insignificant amounts such as BUSD, DAI, ... from other systems brought over.

- Standard Protocol USM: This stablecoin is not currently on the Astar Network, but will be in the future.

The total amount of stablecoins on the system is currently $16.5 million. This amount of stablecoin proves that the Astar Network system has not had a large cash flow, but only a small cash flow of retail investors into the system.

The infrastructure

Infrastructure projects on the Astar Network ecosystem include:

- Oracle: Chainlink, DIA have been integrated into the system.

- Bridge: cBridge, Multichain, Relay, ... have been integrated into the ecosystem for easy cash flow in and out of the system. Cash flow is still mainly going back and forth into the system through cBridge.

- Explorer on the system already has and supports tracking transactions as well as information in the system relatively easily because there are many visualized charts operating on the system (for example, the chart shows the total amount of wallets, total transaction volume, etc. ..), with services provided by Blockscout and Subscan.

- Wallet to store assets, interact with applications on the system, and the most popular is still Metamask.

- Other tools: The Graph, SubQuery announced system integration to support data extraction, Covalent supports API extraction.

Comment: The infrastructure pieces on Astar Network are now relatively complete and serve the applications well. The bridges are enough in both quantity and quantity, the infrastructures for application development as well as for users hardly have to re-develop themselves, because it is an EVM-compatible chain, because So Ethereum's tools and infrastructure can also be used and scaled through the Astar Network easily.

Other pieces

Other projects in the Astar Network ecosystem include:

- NFT projects: TofuNFT (marketplace), NFTY Labs, Lovelace (platform for creators), Mochi,...

- The ecosystem has no NFT and memecoin projects. Although these projects are on the highly speculative system, the appearance of these projects also shows that the ecosystem with a strong cash flow allows new speculative projects to appear.

General comments and forecasts about the Astar Network ecosystem

Identify

As you can see, the Astar system is in the process of building most of the major infrastructure and DeFi pieces, just waiting for other factors to grow strongly. Pieces such as DEX have been completed and are in the process of development, lending and borrowing are in the finishing stage,... and now the ecosystem needs other conditions to attract cash flow.

So what are those conditions? I will make a few projections with you guys below.

Projections

In the coming time, in order for money to flow into the Astar Network ecosystem, some of the following conditions need to be ensured, as well as some new factors we can expect from this ecosystem:

- Conditions to be ensured: DeFi applications in the ecosystem continue to improve, so that basic puzzle pieces such as DEX, lending, etc. work well and stably, creating conditions for the following puzzle pieces to develop. build on these core applications (yield aggregator, yield farm leverage,...).

- The system incentives pack can be rolled out as other ecosystems have done to attract builders and users to the system. That incentive package can be launched as a hackathon or add rewards to farming pools on the ecosystem to drive cash flow into the system.

- Because the system's programming languages are familiar programming languages, not unfamiliar to web3 developers , this should not be a barrier for developers when starting to work on this ecosystem. More hackathons need to be created to gradually attract teams to build ecosystem projects.

- The market situation without new cash inflow also makes it difficult for Astar Network to grow. If the market grows in the near future, then the Astar ecosystem will also be easier to develop.

Epilogue

Hopefully, through the above article, you will have a better overview of the Astar Network ecosystem, the main protocols in the Astar Network system, and start looking for investment opportunities on the Astar Network ecosystem.

What do you think is the next direction of the Astar Network ecosystem? Which ecosystem overview do you want to learn about next? Please comment below the article to let me know!